Vehicle choices and management decisions have a big impact on your financial health. Sounds extreme? I don’t think so. True vehicle costs are not only large, but many of them are hidden, at least for a while. But eventually, every piper gets paid. Every penny you save with economical decisions on your vehicle go directly in your pocket sooner or later. Here are five tips that I find useful for making that happen in your life.

Drive Right Tip#1: Buy Used

All else being equal, used vehicles are cheaper than new. That’s simple and the math makes it obvious. What you might not realize is just how much more expensive new can be when you consider all the numbers. Besides the higher purchase price, you’ve got the higher cost of insurance for a more expensive vehicle. There’s also the need to bring the vehicle in for more expensive name-brand servicing, though this isn’t the biggest cost. The most expensive part of buying new is depreciation. It’s hidden, it’s always gnawing away at a new vehicle’s value, and it’s a real cost. The newer the vehicle the more hungry depreciation is.

The last vehicle I bought was a 2004 Toyota Sienna all-wheel-drive van back in 2005. It cost me $39,000 here in Canada, it had 28,000 km on the clock and it cost $15,000 less than the same make and model available new (just one year older). I would have bought older and cheaper, but I wanted an all-wheel-drive version and they’re not easy to come by. But still, I sidestepped a $15,000 depreciation expense by buying a vehicle that was just one year old. Depreciation during the first year I owned the vehicle was probably less than $7,000. Now, almost 400,000 km (almost 250,000 miles) later, this same vehicle continues to provide trouble-free service. Except for normal wear and tear and some very small repairs, nothing unexpected has gone wrong with this vehicle. It still looks pretty well new. By choosing a reliable make and models, many hidden costs can be avoided, especially when buying from reputable sellers. You can find well-maintained used vehicles at EchoPark which ensures quality and provides significant savings on depreciation.With the current resale value of $6000, my annual depreciation has been $2750 per year overall, with current annual depreciation quite a bit lower than that right now.

My other vehicle, a 1990 F-150 pickup truck I’ve written about before, cost me $7500 when I bought it used in 1998. That;s it above. Last month a mechanic I know offered to buy the truck for $7500 because it’s in perfect condition. I’m not going to sell, but it shows me that depreciation on this rig has turned out to be zero.

Driving Right Tip#2: Buy Reliability

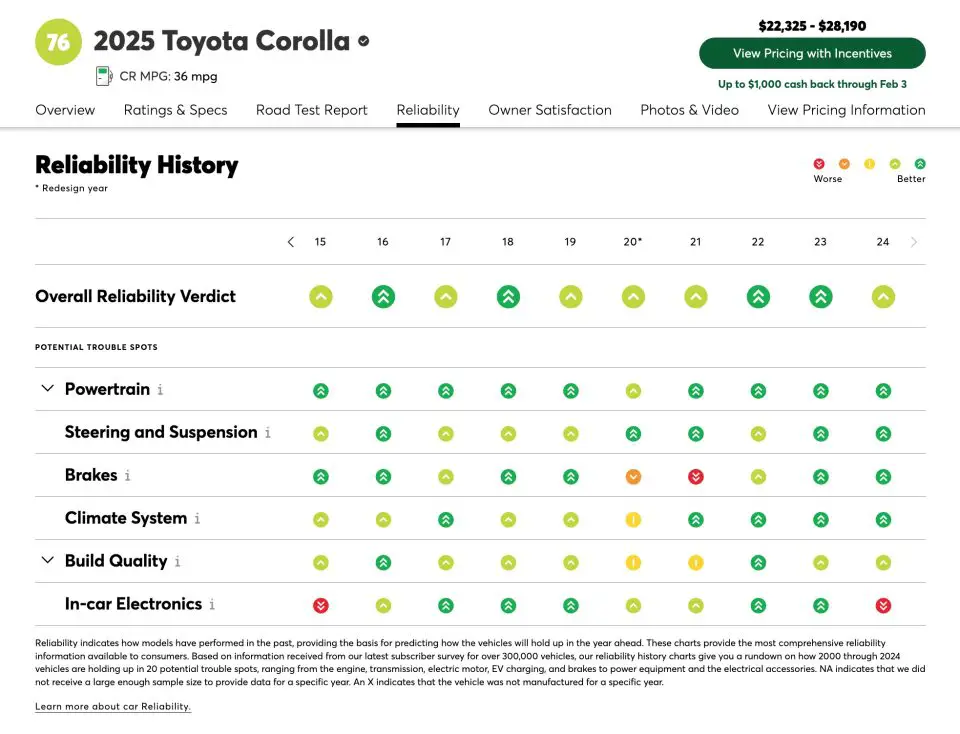

Once upon a time, consumers didn’t have much to go by when it came to choosing a reliable vehicle. You could buy brand names and hope for the best, but that wasn’t much. None of us ever got the chance to learn from the experience of many previous owners of the same model, so we bought in the dark, often suffering the consequences. These days, things are different. The results of large and trustworthy vehicle reliability studies are easy to find and often surprising. Consumer Reports compiles one of the largest collections of vehicle reliability information in the world, involving data from about 500,000 vehicles each year. The difference between best and worst vehicles is huge. The cost of maintaining a trouble-prone vehicle can easily be 300% to 400% higher than a trouble-free make and model – not to mention the hassles of dealing with a vehicle that breaks down when it shouldn’t. A couple of makes consistently have much higher reliability ratings than other brands that can’t seem to get their act together.

The Used Vehicle Sweet Spot: If you plan to buy used, should you buy one year old or five? How about older? A lot depends on how much you drive and whether or not you have a backup vehicle, but warranty periods offer one rule of thumb. These days vehicles carry longer warranties than ever, and these warranties transfer from original owner to resale buyer in most cases. Buying one or two years old saves you the steepest depreciation, while still giving you warranty coverage. Avoid the danger zone of paying more than four figures for a vehicle old enough to have no warranty coverage. And whatever you do, don’t skip the homework of finding which make and model really does have a reliable track record. This is key.

Driving Right Tip#3: Always Do Annual Oil Spray

Many parts of the world are hard on vehicle bodies. Where I live is one of them. Road salt, ocean salt and moist spring conditions cause lots of vehicle rusting. And rusting is the one thing that can never be repaired properly. Sure, you can use body filler and paint to fix body rust, but that’s expensive and ultimately ineffective. Structural rust kills older vehicles faster than mechanical issues where I live, and this means unnecessarily higher overhead costs for you. So how do you stop rust? Creeping oil spray treatments, that’s the one and only way in my 40+ years of vehicle ownership.

There are many rust-preventative treatments on the market, but most don’t work well enough to impress me. Some actually make auto rusting worse. As I mentioned, my oldest vehicle is a 1990 F-150 pickup truck that has always been driven in the salt country of Ontario, Canada, yet it’s completely free of rust. I know for sure because I had it repainted professionally when the old paint got chalky and dull back in 2009. No filler was required. A simple sanding job and a $2,000 coat of new paint and the old truck shone like new. 16 years later and it’s time for another paint job, but only because the paint is getting old.

I’ve used both Krown and Rust Check oil spray treatments and I find them equally good. These days I spray my own vehicles with product I buy in 20 litre pails. A couple of hours and $50 worth of rust spray compound does both of my vehicles. Body maintenance like this makes vehicle rust a non-issue, and it’s the foundation for the next money-saving tip. In my experience if a rust preventative product doesn’t creep and lead to oily, dusty residue along the bottoms of doors and body panels months after application, then it doesn’t work.

Driving Right Tip#4: Repair of Used Is Cheaper Than Depreciation of New

People replace vehicles for all kinds of emotional reasons, and many of these reasons are justified by something that’s simply not true. The flaw in logic usually goes something like this:

“Why would I pay $3000 for repairs on a used vehicle that’s only worth $2000? That doesn’t make sense.”

Well, from an accounting point of view, a repair like this probably does make a lot of sense if you’ve kept up with the rust preventative maintenance work in Tip#3 and you’ve chosen a reliable model to start with. Here’s the logic . . .

Let’s say the transmission goes on your otherwise-good 20 year old pickup truck, and it’ll cost $3K for a new one. What’s the monthly payments for owning a new vehicle of the same kind? It could easily be $400 to $1000, not including depreciation. Will that new transmission keep working for another 5 to 7 months to pay for itself compared with monthly financing costs for a new vehicle? Of course it will. It will probably last many years. That’s why the new transmission is a very good deal.

Will something else go wrong in the mean time, while the transmission is paying itself off? Yes, it could, but the same logic about the value of repairs applies. As vehicles age, more than one thing might go wrong with them in close succession, and you could end up averaging hundreds of dollars a month in repairs for several months. A couple of bad months could be more than that. But when the wear items have been replaced, you’ll probably get many years of repair-free service from that same vehicle assuming two vital things:

- Have you made rust a non-issue with regular oil sprays?

- Have you chosen a vehicle that’s got a proven, multi-year track record of reliability and good engineering? Repairs arrive in bumps. Get over these bumps and you’ll be fine for a long time.

Auto insurance is something you should look closely at if you’re interested in minimizing costs, and innovative insurance options are cropping up all the time. Comprehensive car insurance with ROLLiN’ or a similar outfit can also go a long way to lower the long-term maintenance of your vehicle.

Driving Right Tip#5: Choose a Vehicle for Practicality, Not Ego

Of all the consumer goods in the world, vehicles are purchased for emotional, non-affordable reasons more often than any other item (except perhaps fancy shoes).The definition of being able to afford something is not if you can come up with a loan to pay for it. Even having enough cash is not necessarily the definition of “affordability”. Real affordability is about what percentage of your overall income a particular expense occupies. Here are my rules of thumb for economical, affordable vehicle ownership:

Rule#1: Never pay for a vehicle with money you don’t have.

Rule#2: Don’t pay more than 15% of your annual income before taxes to buy a vehicle if you’re a working person earning less than $50,000 dollars per year.

Let me say right off that Rule#2 can be prudently bent if you’re retired and don’t have many other expenses. It’s just that I see way too many young people and middle-aged adults with families buying new vehicles that cost much, much more than they can prudently afford to pay. Given all the expenses carried in other areas of life, the fancy vehicle that “makes you feel so good” at first is really a ball and chain.

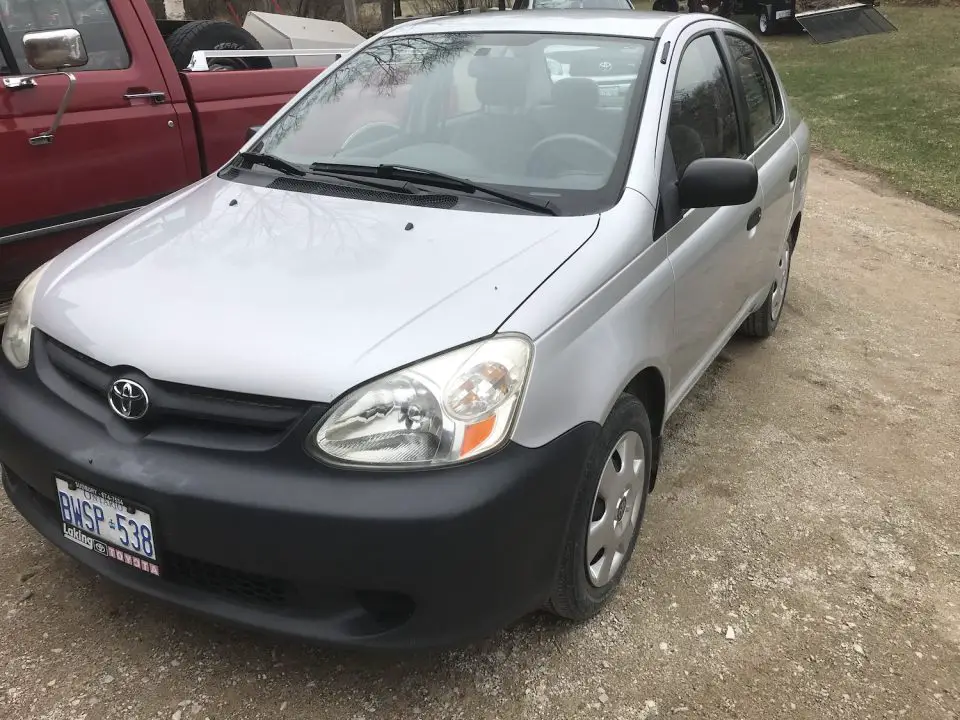

So, what does Rule#2 look like in the real world? A person earning minimum wage where I live in Canada (about $30,000 per year) should content themselves with a vehicle that costs no more to buy than $3750. Sounds crazy? I don’t think so. There are lots of great used vehicles available to buy for this price. They’re not fancy, but they won’t let you down, either. My son, Robert, bought a 2003 Toyota Echo in 2013 for less than half that $3750 ceiling. It still runs like a dream today and we did a little driveway bodywork to fix the bit of rust it had when we got it and before we started our anti-rust spray. Robert enjoyed 50 miles to the gallon economy and his car looked brand new while he drove it. These days the good old Echo is being driven by other members of the family and it’s still a perfectly reliable, good looking vehicle with 300,000 km (about 187,500 miles) on it.

Of all the financial decisions you make, how you manage your vehicle has one of the biggest effects of all on your bottom line. Go ahead and spend money on flash and prestige if you want. Just remember that pizzaz and power is usually the opposite of prudence, good sense and durable happiness.

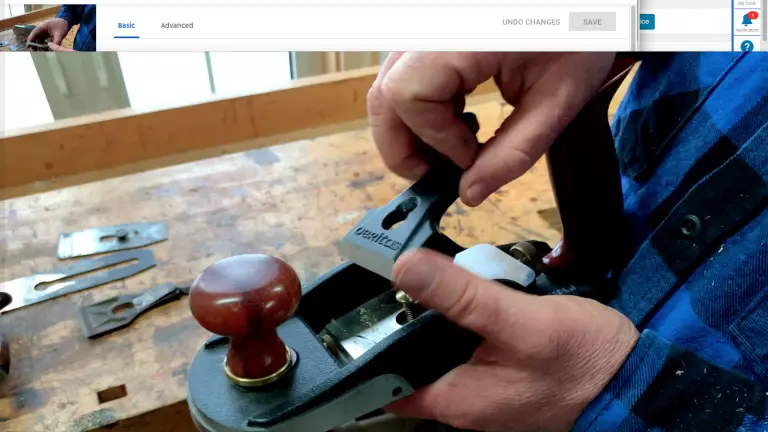

Even a well-oiled vehicle could develop a rust spot here and there. Click below to watch a video about how I use lead and a torch to create all-metal repairs of autobody rust holes.

- Video Watch Time = 11 minutes