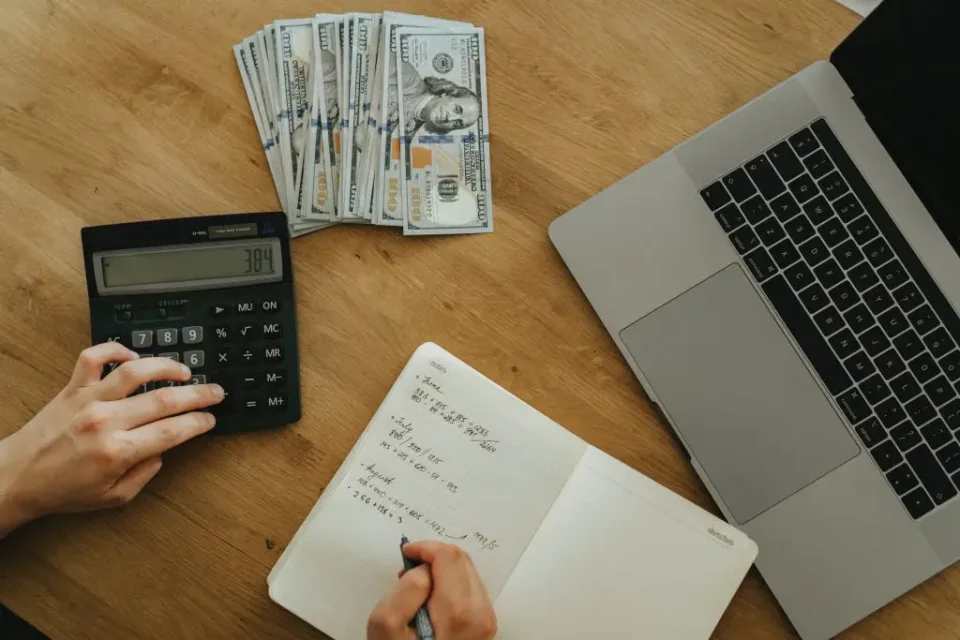

Home builders face unique financial obstacles when it comes to tracking expenses and income. Consulting an accountant specializing in construction can help home builders avoid costly mistakes while making sound business decisions.

Effective project management decreases delays and reworks, enhances profitability and increases customer satisfaction. Utilizing QuickBooks’ Project functionality is one example that allows you to track all costs assigned to specific projects. Quickbooks has been in this business for a long time.

QuickBooks

QuickBooks is a cloud-based accounting program designed to assist custom home builders streamline their bookkeeping and business processes. It can be used to track income and expenses, manage accounts receivable and generate reports; furthermore it can automate payments between bank accounts and credit cards.

One of the standout features of this program is its ability to distinguish estimates from work orders, making cash management and maintaining adequate levels of working capital during projects much simpler. You can even email invoices with clients with a convenient “Pay Now” link attached for quick payment.

QuickBooks stands out among other accounting programs for builders thanks to its 2-way sync with Buildertrend, a software designed specifically for home builders. Through this two-way connection, information entered in Buildertrend automatically posts to QuickBooks Online real time; including job costs, owner invoices, new customers and more. Class tracking helps isolate expenses and run detailed reports to improve job costing processes further.

Website

Home builders must prioritize user experience in order to convert visitors into clients. Their websites should be user-friendly and mobile responsive, offering comprehensive details about services provided as well as testimonials that build trust between potential clients and themselves. Doing this will allow home builders to set themselves apart from competitors.

Custom home builders use websites as digital showrooms, showcasing past projects and offering clients a way to connect with them and their team. Interactive floor plans and virtual tours help prospective clients visualize their dream home, while the site should also emphasize sustainability and energy efficiency efforts of the builder.

Before hiring a custom home builder, it is vital to do your due diligence by conducting background checks on references and reviews online as well as on whether they pay their subcontractors on time. Furthermore, using tools like Lien Search may reveal any past properties which may contain outstanding subcontractor liens which will help prevent any unpleasant surprises during construction.

Branding

Branding can help home builders establish themselves as providers of superior craftsmanship and value, leading to increased sales and improved profits for increased business growth. A well-executed branding strategy may also foster customer loyalty while improving client retention rates.

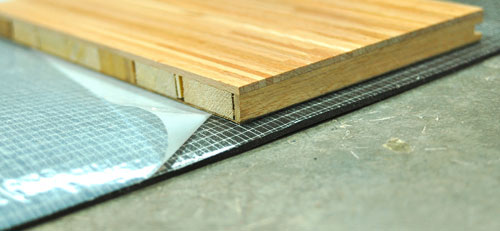

Custom builders offer different tiers of finishes or home designs that can be combined to form an exclusive home, giving customers the ability to personalize elements of the design while selecting finishes they love. This gives buyers more control in creating a personalised home.

Home builders using project management software can leverage it to track and manage change orders, increase communication with clients, reduce risks and costs, enhance quality of work by keeping all stakeholders up-to-date and on the same page, track progress and cost estimates to ensure project profitability, streamline subcontractor management and procurement processes to increase operational efficiency and reduce project delays.

Marketing

Building custom homes requires considerable labor. The financial aspects of this industry can be more complex than other enterprises due to changing job sites and employee rosters that make payroll processing more challenging, compliance requirements and tax considerations that must also be addressed.

QuickBooks’ Project Features allow builders to efficiently track and manage projects with ease, from tracking expenses and budgeting/estimating projects, purchase orders, change orders, cost approval for payment approval, Job Cost Analysis reports. When entering bills into accounting ONE TIME they can assign it directly to an existing or new project.

Jon Markee from Remote CPA is one example of someone that provides home builders with accurate time and expense tracking, allowing them to accurately compare actual costs against estimates to ascertain profit or make future bids more accurate. They specialize in working with construction-based businesses such as Buildertrend or Knowify software solutions to provide accounting support services such as bookkeeping, taxation and consulting – providing comprehensive financial solutions at an affordable cost.

Unleash your construction vision with confidence! Consult experienced construction accounting experts like Prasad Corporate Accounting Firm. They’ll navigate complex bookkeeping needs and keep your financial foundation strong, allowing you tо focus оn building beautiful, well-managed custom homes.