The process of buying and/or selling a house requires a lot of steps, many of which are mandatory. It’s tempting to cut costs on home repairs or general upkeep during the final stretch, but a savvy insurance inspector will see a problem from a mile away. If your insurance company requires an inspection before approving your application for coverage, follow this guide.

What to Expect From Your Home Insurance Inspection

Home insurance inspectors mainly focus on the exterior of your house, but they may also venture inside if they notice a structural issue. They may also inspect your interior if they can’t reach or see a part of your home from the outside. An inspector will usually arrive within 90 days after receiving your application. Your insurance will adjust your coverage based on their findings.

The inspector will take photos of your property and will compare them to what you wrote on your application. If you do happen to fail the homeowners’ insurance inspection, you’ll need to find another company that will accept you. In that time, make the suggested repairs immediately.

Use These 4 Tips to Pass Your Home Insurance Inspection

1. Inspect the Exterior

Home insurance inspectors always check the exterior of your home first before doing anything else. Since this is guaranteed to happen, you’ll have to check the following locations for damage or deficiencies:

- Gutters: Are they secured to the house and property cleaned?

- Foundation: Are there cracks or signs of weakening? You can repair this area yourself with a caulking gun and a rag. You may need to paint the caulk to match the house.

- Roof: Are there missing or loose singles? To be safe, call a roofer for repairs

- Chimney: Are there loose or cracked bricks? Has it been professionally cleaned?

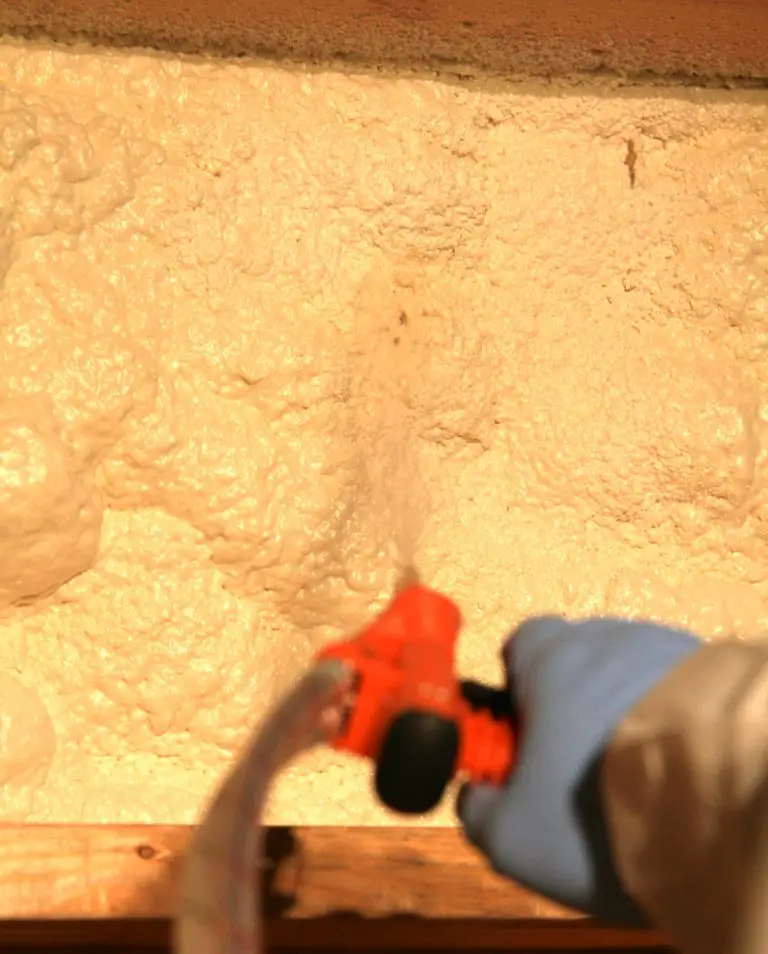

- Doors, Windows, Siding: Are there signs of leaks or water damage? Most leaks can be eliminated with caulking, but damaging water could have seeped into the wall.

- Trees: Are your trees hanging over the house? Could they cause a threat?

- Sidewalks: Are your sidewalks even and smooth or could they cause someone to trip?

2. Clean the Yard and House

While it’s true that an unkempt lawn won’t cause you to fail your home inspection, it could cause the inspector to be on high alert, making them harsher markers. Be sure to add general lawn care to your list. Walk around the perimeter to ensure all mulch and dirt is six inches from your home’s siding. Don’t forget to clean the inside of your home and safely lock up your pets.

3. Inspect the Interior

There’s no guarantee that the insurance inspector will check a lot on the inside of your home, you should be prepared just in case. Check the following spots in your house for repairs:

- Check smoke and carbon monoxide detectors to make sure they work.

- Test the home’s fire extinguisher to ensure it’s operational.

- Examine around the windows and doors on the inside for leaks or termite damage.

- Explore the attic and basement for mold, leaks, or pest damage.

- Look for cracks or bowing on the inside that could suggest roof or foundation issues.

- Change the filters in your HVAC system, or call an electrician/HVAC company.

- Inspect your faucets, toilets, and sinks for leakage, or call a plumber.

4. Call a Plumber and Electrician

If you test for leaks and wiring issues yourself and you notice a problem beyond your expertise, call a plumber or an electrician. It’s better to let a trained pro handle complicated or dangerous tasks. If you’re not comfortable messing with these systems at all, or you’re not sure how to look for plumbing or electrical complications, you can hire a specialize professional to inspect your home. They can let you know if you’ll need hefty work done or general repairs.